Are Wall Street Analysts Bullish on Paycom Software Stock?

/Paycom%20Software%20Inc%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $13.1 billion, Paycom Software, Inc. (PAYC) provides cloud-based human capital management (HCM) solutions delivered as software-as-a-service. Its platform streamlines the entire employee lifecycle from recruitment to retirement through integrated applications for payroll, talent acquisition, HR management, time tracking, and compliance.

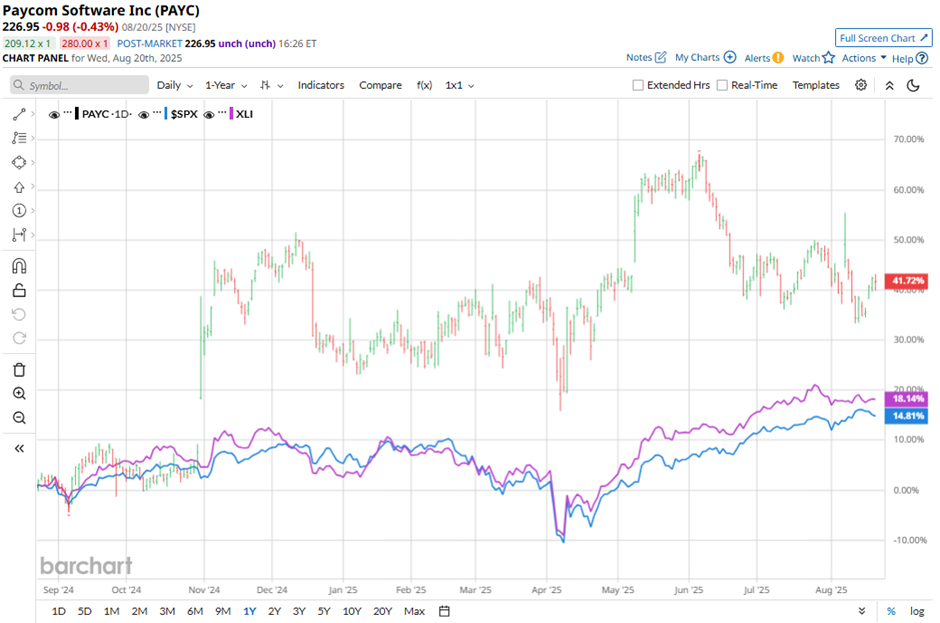

Shares of the Oklahoma City, Oklahoma-based company have outperformed the broader market over the past 52 weeks. PAYC stock has climbed 43.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. Moreover, shares of Paycom Software are up 10.7% on a YTD basis, compared to SPX’s 8.7% gain.

Focusing more closely, shares of the human-resources and payroll software maker have also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 18.7% return over the past 52 weeks.

Shares of Paycom soared 4.5% following its Q2 2025 results on Aug. 6, with adjusted EPS of $2.06 and revenue of $483.6 million, surpassing the forecasts. The company raised its full-year revenue outlook to $2.05 billion - $2.06 billion and boosted its core profit forecast to $872 million - $882 million. Investor optimism was further fueled by strong demand driven by Paycom’s new AI-powered features, which automate HR tasks and enhance employee management capabilities.

For the fiscal year, ending in December 2025, analysts expect PAYC’s EPS to decrease 12.3% year-over-year to $7.56. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

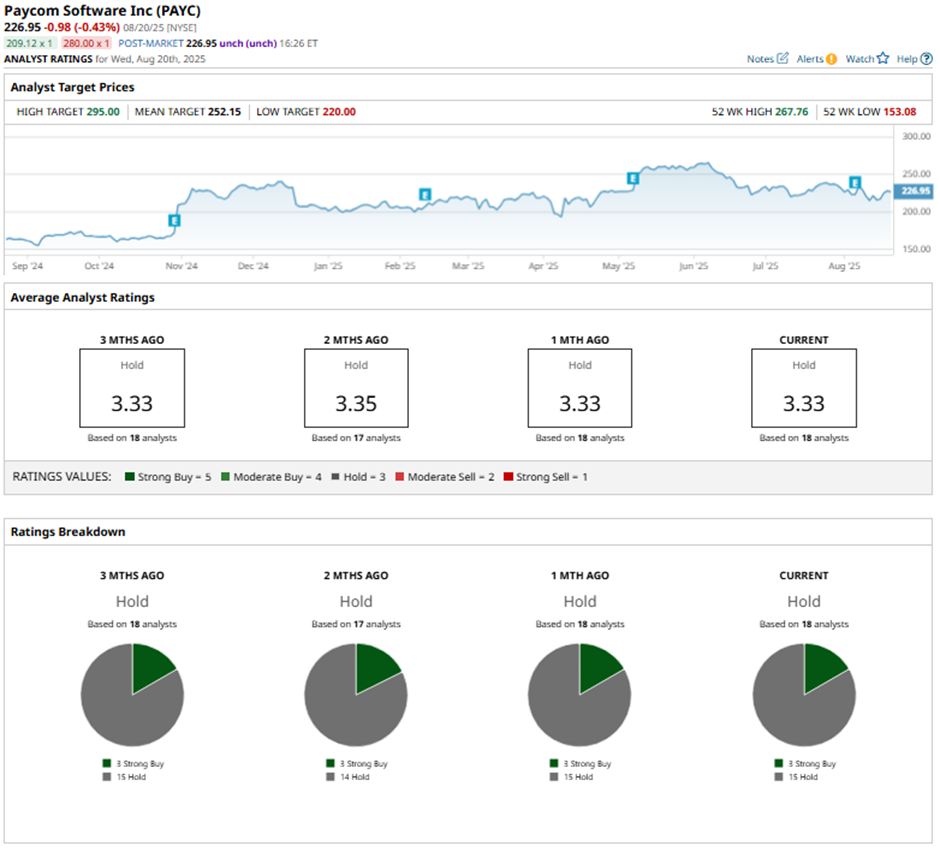

Among the 18 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings and 15 “Holds.”

On Aug. 7, BMO Capital raised Paycom’s price target to $258 with a “Market Perform" rating, citing the company’s Q2 beat-and-raise results and the upcoming launch of its AI search engine, IWant.

The mean price target of $252.15 represents a 11.1% premium to PAYC’s current price levels. The Street-high price target of $295 suggests a nearly 30% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.